1101 results found

Featured results

More results

The first meeting under the Indian G20 Presidency of the G20 Finance Ministers and Central Bank Governors in Bengaluru, India was a productive meeting, despite the ongoing problems evident on the global stage. Our CEO Marie Lam-Frendo discusses the outcomes.

This report was produced by an expert panel tasked with independent review of multilateral development banks’ capital adequacy frameworks. This panel was convened by the G20 to provide benchmarks to evaluate MDB capital adequacy frameworks and to enable stakeholders to develop a consistent understanding and consider potential adaptations to maximise MDBs' funding capacity.

The Miundo Misingi Hub capacity-building program in Africa is improving collaboration between the public and private sectors and shifting the continent's infrastructure financing.

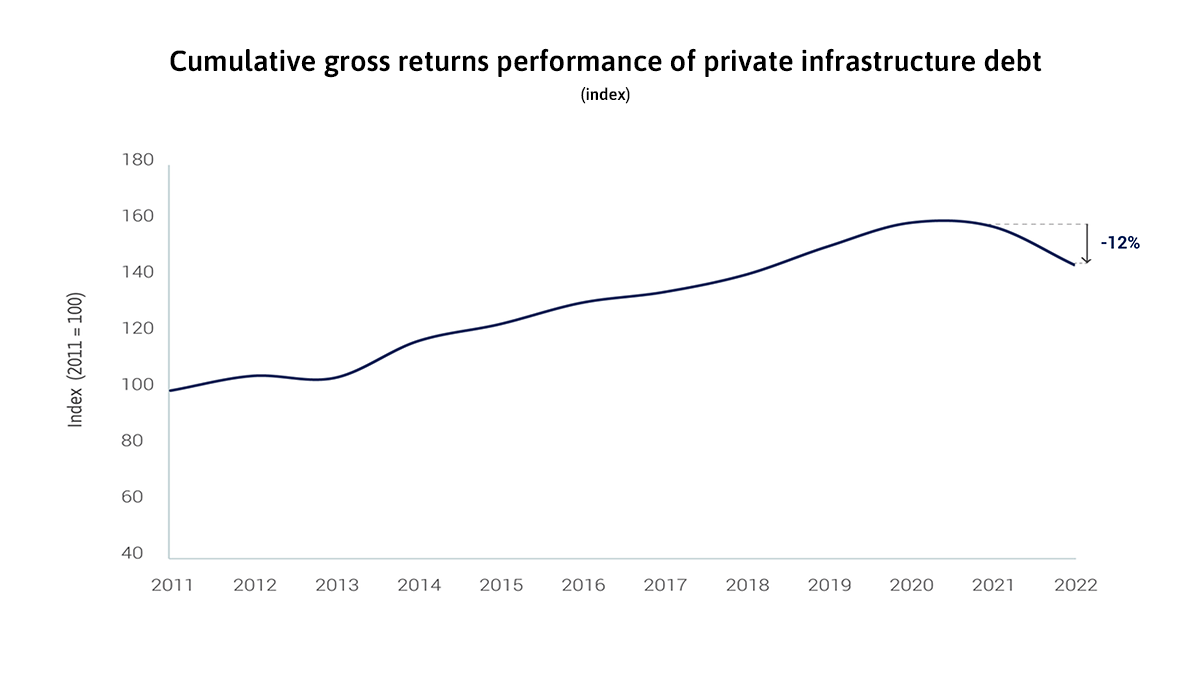

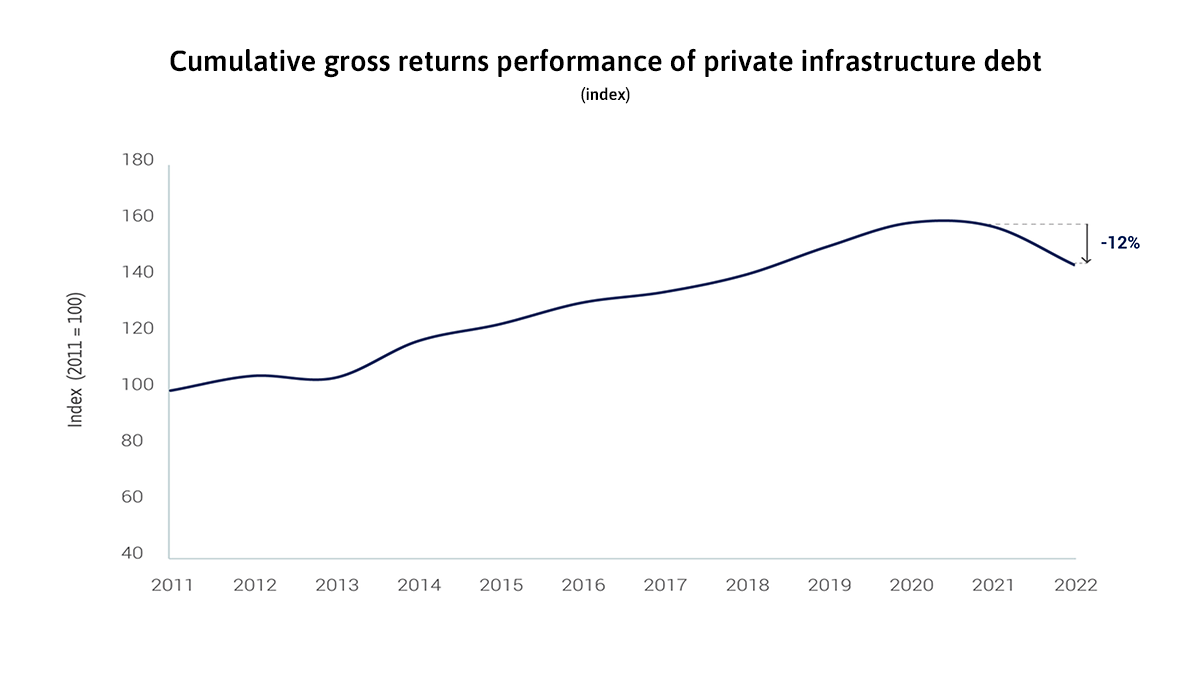

Rapid and sharp interest rate hikes in 2022 lowered the market value of existing infrastructure debt locked-in at the previous lower rates. Still, the attractiveness of infrastructure debt increased among private investors on account of its lower credit risk than corporate debt and increasing investors’ risk aversion

The InterAmerican Development Bank´s Sustainable Infrastructure Framework aims to help foster shared understanding of the key dimensions and attributes of sustainable infrastructure. The IDB Framework was adapted to Mexico after a thorough analysis of Mexico’s national development strategy and infrastructure investment priorities, in close collaboration with relevant stakeholders.

Amidst rising interest rates and soaring inflation, infrastructure debt is an increasingly attractive investment strategy for private investors. Alex Murray, Vice President, Research Insights, Preqin explores this trend and what it means for infrastructure investments.

Post-COP15, GI Hub's Strategic Adviser Denis Crevier explores some meaningful outcomes for biodiversity and its influence on infrastructure.

What qualifies as critical infrastructure, and what can governments and industry do to increase its resilience? We spoke to four experts for their perspectives.

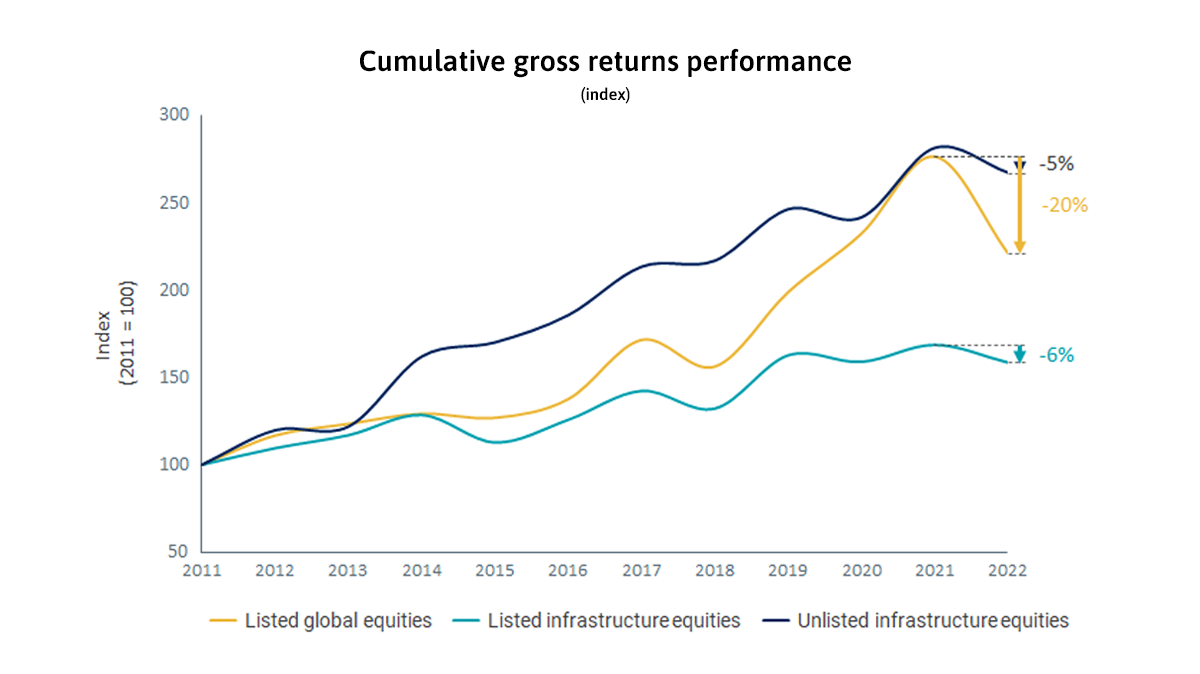

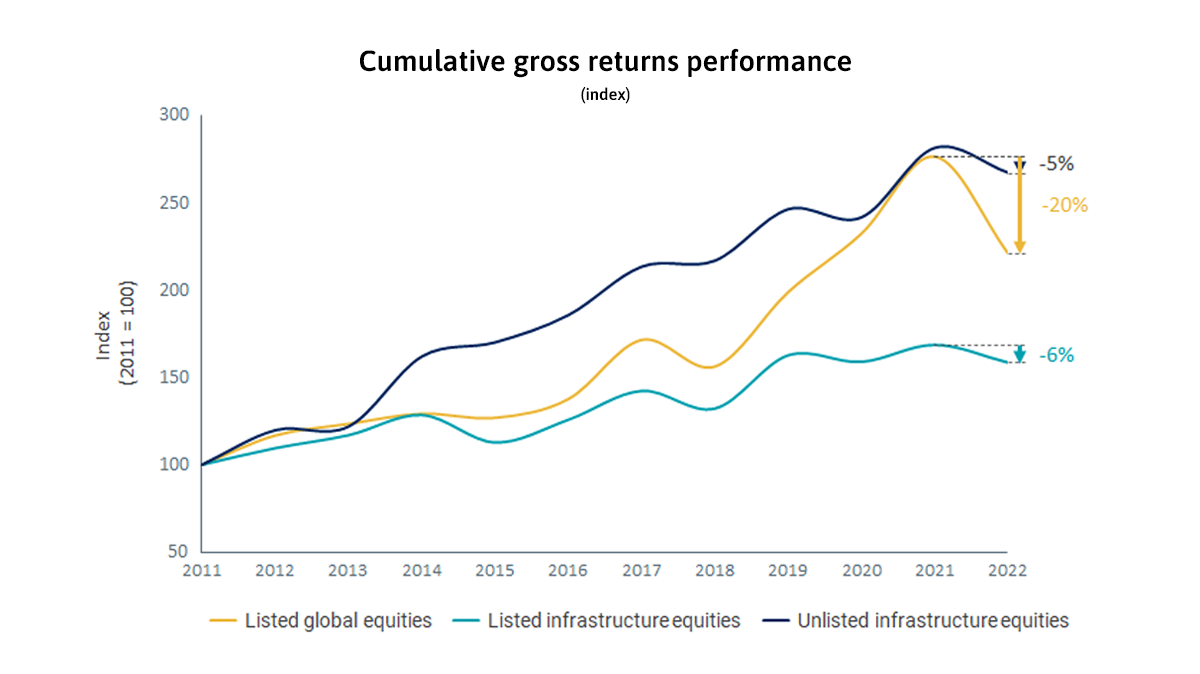

Infrastructure equities provide stronger protection against inflation shocks than the broader equity market. During the rapid inflation shocks in 2022, the return on infrastructure equities was more resilient than that on global equities, which drove private fundraising for infrastructure to record levels.

A summary of the first G20 Infrastructure Working Group meeting under the Indian G20 Presidency in January 2023

In this Q&A our CEO, Marie Lam-Frendo explores how the G20 has the power to help bridge the current infrastructure investment gap - a gap that is hindering strong, sustainable development.

In 2021, private investment in infrastructure projects in primary markets recovered to its pre-pandemic level but remains stagnant and far shy of what is needed to close the infrastructure investment gap.

This book questions the premise that Public-Private Partnerships (PPPs) have a performance advantage over traditionally procured projects. It examines novel research comparing the differences in performance between PPP and traditionally procured infrastructure projects and thoughtfully scrutinises the supposed advantages of PPPs.

This study examines all aspects of the digitalisation of infrastructure for a sustainable future

This report from the World Bank looks at the European Union's experience in furthering a circular economy, highlighting lessons that can benefit countries within and beyond Europe’s borders.

The Global Infrastructure Investor Association (GIIA) in partnership with PwC, published Unlocking Capital for Net Zero Infrastructure. Based on interviews with infrastructure investors, the report identifies an urgent and immediate need for additional investment in order for the UK to meet its ambitious net zero targets.

The Future of Regulation lays out a set of core principles that the Global Infrastructure Investor Association believes can effectively and fairly govern the UK’s regulated utility sector for decades to come, and forms a key part of the GIIA's engagement with HM Treasury on this important policy area.

The Global Infrastructure Investor Association, in partnership with Marsh & McLennan, examines the impacts that rapid technological advancement are having on infrastructure assets around the world and what these will mean for the sector in years to come.

First FMCBG Meeting, 22-25 February 2023, G20 Chair's Summary

First FMCBG Meeting, 22-25 February 2023, G20 Chair's Summary