24 results found

Featured results

More results

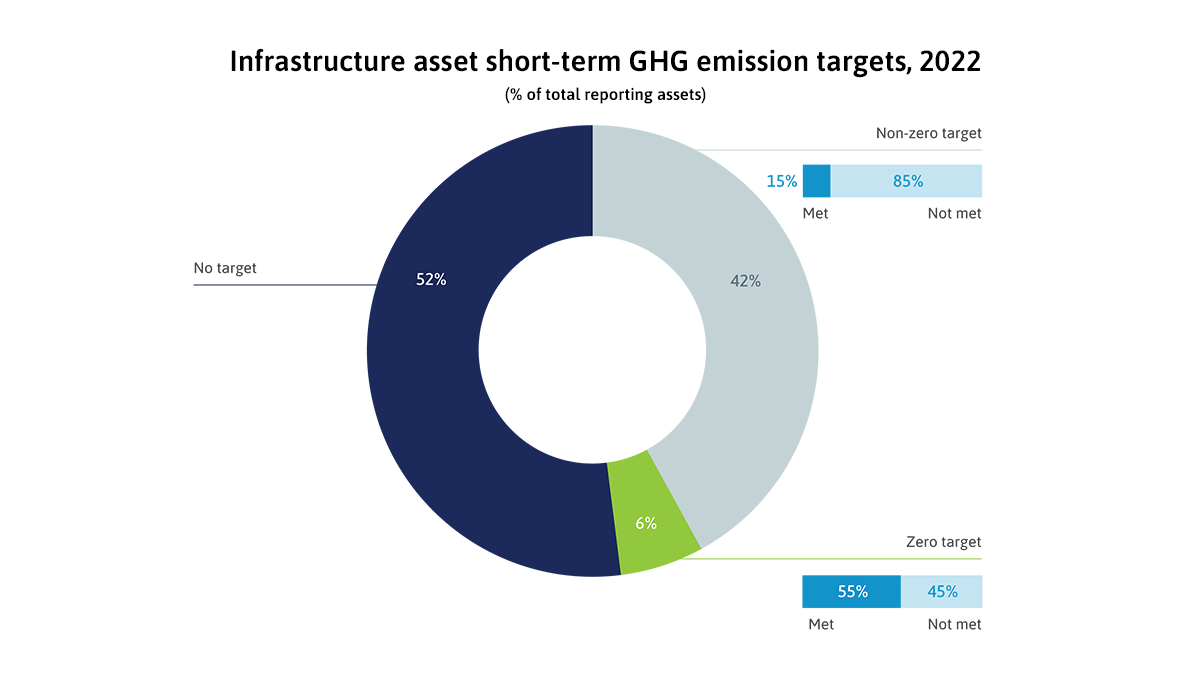

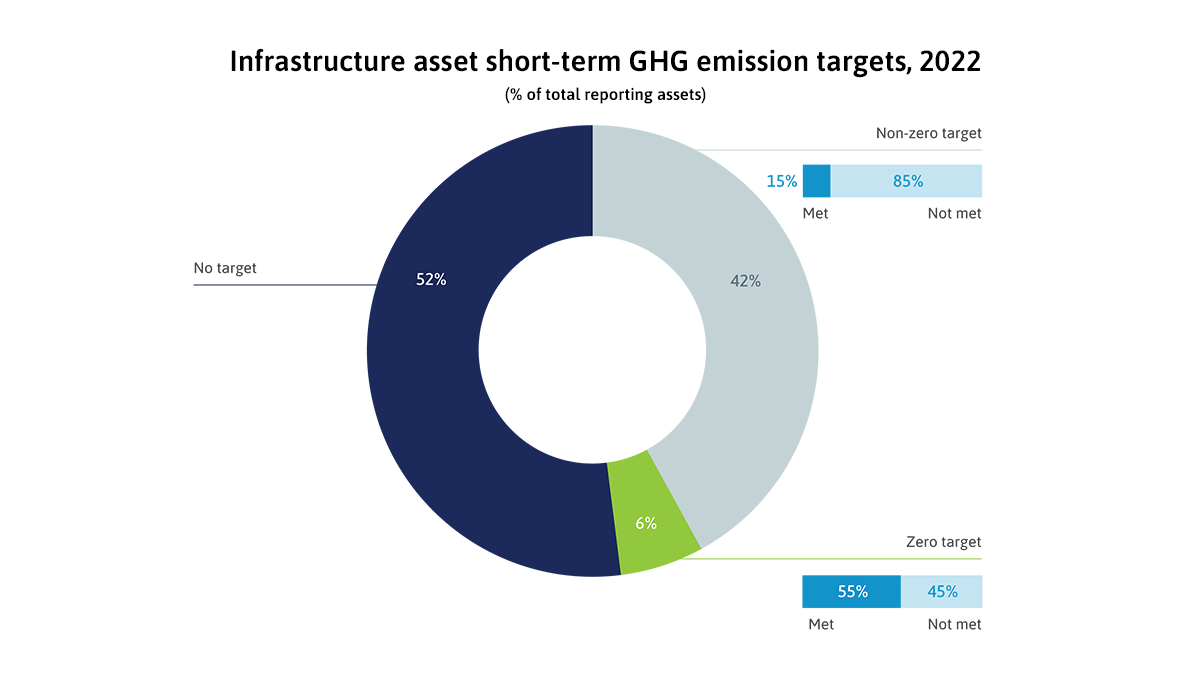

Today we released two new supplements to our Infrastructure Monitor report, focusing on the role of blended finance and environmental, social, and governance (ESG) factors in infrastructure investment. These latest updates, developed in partnership with Convergence and GRESB, offer a comprehensive examination of both areas, providing valuable insights for infrastructure professionals.

Introducing a new professional training program for developing and delivering infrastructure for equal access, affordability, and economic empowerment.

Our CEO has contributed an article to the G20 India: The 2023 New Delhi Summit publication, alongside articles by country leaders, heads of international organisations, and other experts.

Our latest article with the Wilson Center

AsianInvestor interviews our CEO on the critical role of investors in promoting net-zero targets in infrastructure

Our latest Q&A explores the key objectives, learnings, and insights from the Infrastructure Governance in Canada Report

The report was created to establish a shared set of principles to unite the sector and assist in aligning policies, strategies, and initiatives towards a circular economy.

McKinsey interviews our CEO, Marie Lam-Frendo about key strategies to help infrastructure leaders to attract private investment and meet net zero goals

Interrelated challenges are common bottlenecks in the planning process for linear infrastructure designed to address climate change. This article explores how the Linear Infrastructure Planning Panel is enabling InfraTech for accessible decisionmaking.

The carbon finance market is evolving rapidly but is fragmented and complex. With project and political risks affecting the private sector’s willingness to enter new carbon markets, what can governments of developing countries do to scale up participation?

In 2022, infrastructure assets improved their ESG scores in all three pillars of ESG. The scores are encouraging, but they do not mean the assets themselves are more sustainable.

The G20/GI Hub Framework on How to Best Leverage Private Sector Participation to Scale Up Sustainable Infrastructure, which sets out opportunity areas and actions for the G20 to enable the private sector to scale up its investments in sustainable infrastructure.

This report leverages the experience of NGFS members and observers, as well as a survey of 25 central banks and 24 financial supervisors, to examine key challenges related to market transparency in green finance - particularly with regard to taxonomies; green external review and assessment; and climate transition metrics, frameworks, and market products. It also aims to inform a broad dialogue with market participants to find potential solutions to policy challenges.

How sustainable infrastructure is a key enabler of the transition to a low-carbon economy and an important driver of resilient, inclusive growth

The GI Hub recently hosted a webinar that provided participants with a data-informed understanding of the state of infrastructure investment. In this article we present the main takeaways from the event.

Regulatory treatment of infrastructure as an asset class

Regulatory treatment of infrastructure as an asset class