118 results found

Featured results

More results

The LTIIA's report on Climate-Resilient Infrastructure: How to scale up private investment examines the current state of climate-resilient infrastructure investment and brings forward recommendations and proposals.

Five key infrastructure ideas from Climate Week NYC by our Director of Engagement, Rory Linehan and Partnership Manager, Daniel Galle.

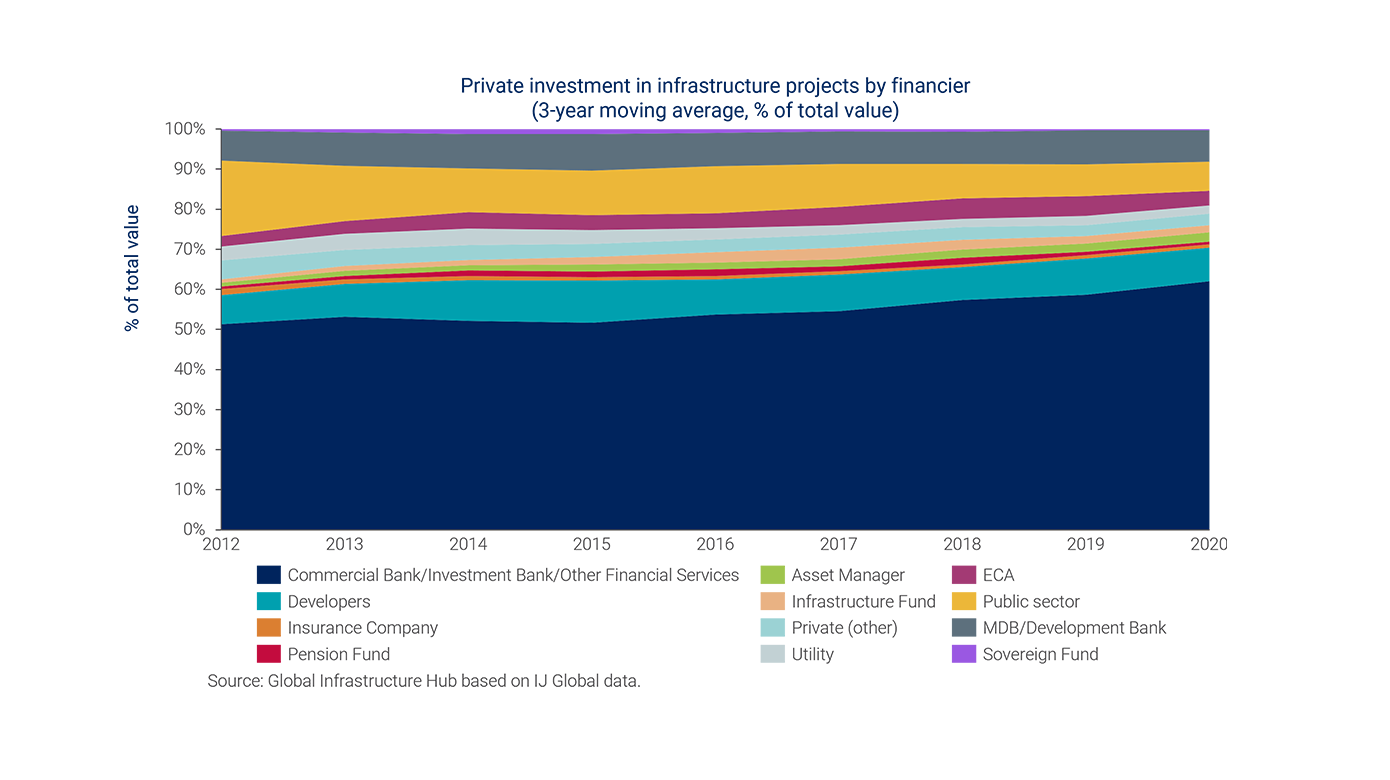

Private investment in infrastructure remained stagnant for the eighth year in a row. Three trends to inform future policies to fund the significant shift to enable infrastructure to reach climate targets and address global inequalities.

Watch the webinar hosted by GI Hub and IFC, in collaboration with the G20 Indonesian Presidency, on enhancing social inclusion and addressing subnational disparities

This recently updated directory of national and subnational project pipelines in G20 countries enables governments and industries track projects and assemble market analyses

Read our story on the importance of leveraging blended finance to drive private investment in sustainable infrastructure that’s featured in the July/August 2022 issue of InfraInvestor.

The last decade has seen a growing investor appetite toward sustainable infrastructure investments. However, there are challenges to accelerating these investments at the speed and scale needed. In this article we explore two projects - the Tibar Bay Port in Timor-Leste and the Clean Ganga Program in India - that illustrate how these challenges can be overcome.

Ahead of the G20 Finance Ministers and Central Bank Governors meeting this week, GI Hub CEO Marie Lam-Frendo provides insights into the actions we’re helping advance in our work with the G20.

The GI Hub recently hosted a webinar that provided participants with a data-informed understanding of the state of infrastructure investment. In this article we present the main takeaways from the event.

The COVID-19 pandemic boosted investors’ interest in digital infrastructure and digital services. Policymakers have an opportunity to amplify these effects by accelerating market reforms

Join the GI Hub for an overview of investment in the infrastructure sector and hear experts discuss the decisions that will drive strong investment outcomes as well as positive global impacts.

Integrating ESG into infrastructure decisions requires a systematic and verifiable governance (implementation) approach of a projects ability to reduce environmental and social risk alongside long-term value for investors

The GI Hub began examining the regulatory capital treatment of infrastructure investments in 2019, as part of our initiative to address barriers to the establishment and advancement of infrastructure as an asset class

To seize the opportunities of this critical moment and increase private investment in infrastructure LMICs can implement a series of actions. The creation of a regulatory and institutional framework which promotes private investment or the development of solid project pipelines.

One Planet Summit reports on how blended finance can help scale up climate and nature investments.

Kathrin Heitmann, CFA, Vice President - Senior Credit Officer, Global Infrastructure and Project Finance Group, Moody's Investors Service explores data-related findings that highlight how project and infrastructure debt continued to perform well during the COVID-19 pandemic.

Equity and debt performance show that infrastructure as an asset class provides attractive and resilient returns for investors and unlisted infrastructure equities generated the highest returns and risk-adjusted returns.

Infrastructure Monitor is the GI Hub's annual flagship report on the state of investment in infrastructure.

Infrastructure Monitor is the GI Hub's flagship report on the state of investment in infrastructure. The 2021 report examines global private investment in infrastructure projects, infrastructure investment performance, project preparation, ESG factors in infrastructure investment, and COVID-19 impacts.

Transformative Outcomes Through Infrastructure

Transformative Outcomes Through Infrastructure