118 results found

Featured results

More results

Banks are leaders in structuring and financing private investment in new projects, however recent banking regulations discourage them from prioritising infrastructure

McKinsey interviews our CEO, Marie Lam-Frendo about key strategies to help infrastructure leaders to attract private investment and meet net zero goals

With infrastructure responsible for 79% of global GHGs, JETPs have great potential to rebuild trust among stakeholders and help mobilise private climate finance to support the climate transition and sustainable infrastructure development broadly. The JETP platform offers a valuable sandbox to co-create and validate new approaches and innovations while firming up political will

Public investment is 83% of all investment in infrastructure, and lack of data about how this investment is prioritised and allocated impedes private participation and investment. The GI Hub’s InfraTracker is the first annual tracker of public investment in infrastructure for the G20. This article delves into how we estimate public investment priorities, and why doing so isn’t as straightforward as it may seem.

The credit risk metrics for infrastructure debt improved during the COVID-19 pandemic, while those for non-infrastructure debt worsened. The performance of infrastructure loans demonstrates that infrastructure assets are resilient to adverse economic scenarios like pandemics.

A collection of resources to provide solutions and case studies of effective funding and financing approaches.

At last week’s meetings of the G20 Finance Ministers in Washington DC in the margins of the World Bank / IMF Spring Meetings, conversations continued to drive toward action on debt, reform of multilateral institutions, and sustainable finance and investment for the climate transition.

InfraTracker is an open access tool that shows how much governments invest in infrastructure, and how they allocate this investment. It is the first tool of its kind and scale to be developed with the cooperation of G20 governments.

Recently, the GI Hub coordinated a discussion of asset recycling as part of a presentation to fellows of the ASEAN Sustainable Leadership in Infrastructure Program.

"We have multiple gaps to fund, requiring not billions, but trillions"

Transformative changes are needed to unlock infrastructure financing and fill multiple gaps in financing climate, biodiversity, and infrastructure gtargets.

The GI Hub’s InfraTracker aims to help address this data gap by analysing public investment data presented in G20 government budgets

Comparison of InfraTracker data with private investment figures in Infrastructure Monitor also indicate that, in general, governments are the driver of investment in all infrastructure sectors except for energy.

Infrastructure investment undoubtedly has a strong impact on economic growth and development.

InfraTracker tracks public investment in infrastructure to help governments shape programs and budgets that achieve the best outcomes.

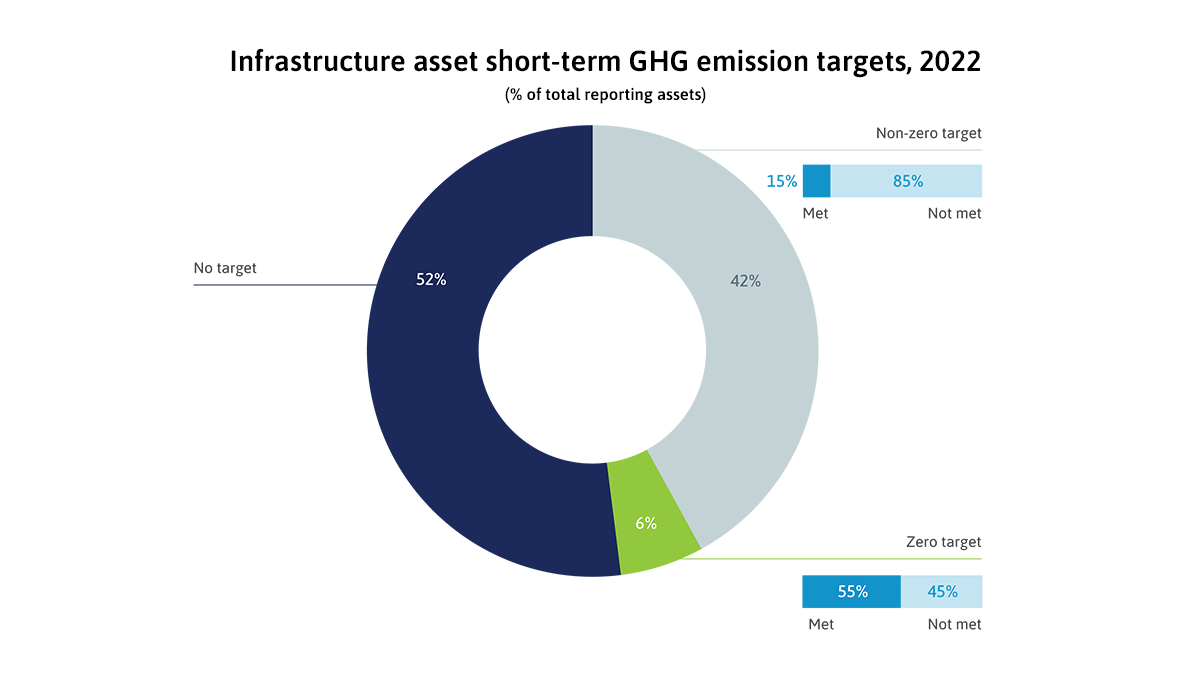

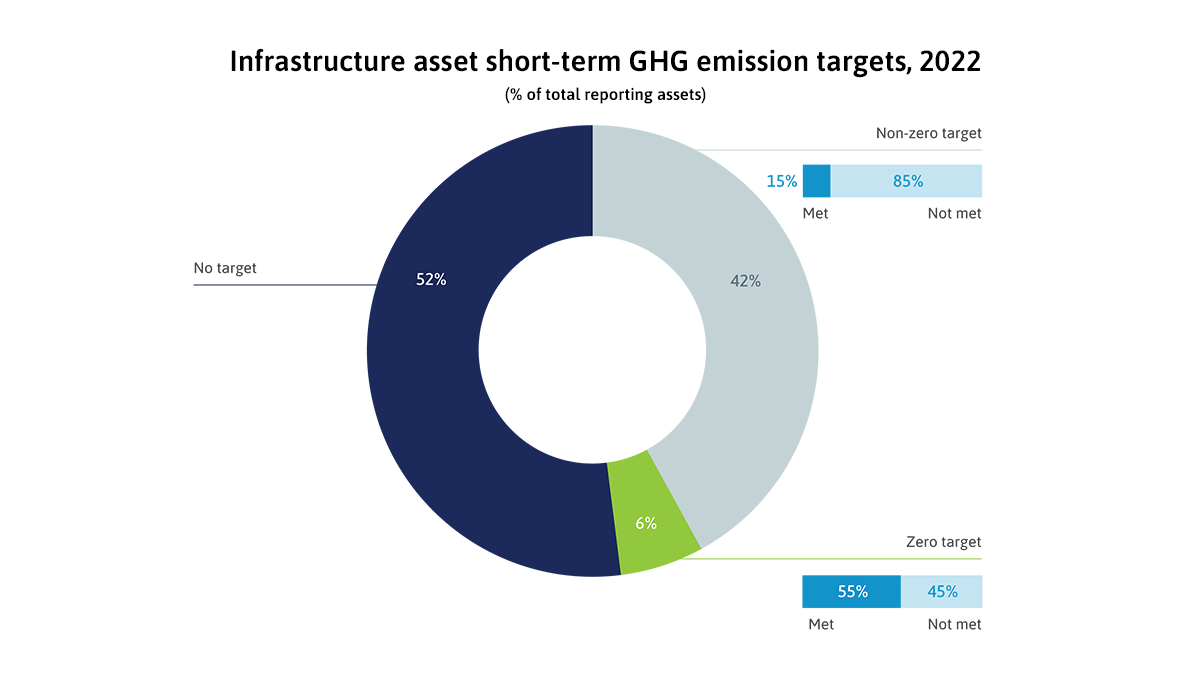

In 2022, infrastructure assets improved their ESG scores in all three pillars of ESG. The scores are encouraging, but they do not mean the assets themselves are more sustainable.

This article reviews five economic shocks that are worsening the bankability of new infrastructure projects, and eight approaches to improve bankability and get projects off the ground.

Recently, the GI Hub coordinated a discussion of asset recycling as part of a presentation to fellows of the ASEAN Sustainable Leadership in Infrastructure Program.

Infrastructure definitions and classifications (taxonomies) have a huge impact on how much gets invested in infrastructure and what types of infrastructure get this investment. This week the G20 and GI Hub held a roundtable on infrastructure taxonomies to explore how they can be used to help close the infrastructure investment gap.

Despite the turmoil in the banking sector, now is not the time to become more risk averse about investing in infrastructure.

Regulatory Treatment of Infrastructure as an Asset Class

Regulatory Treatment of Infrastructure as an Asset Class