Articles

Filter by

196 results found

Articles

To celebrate International Women’s Day 2022, we interviewed three female leaders at the GI Hub to explore how we can collectively #BreakTheBias and address inequality in infrastructure. The first Q&A in this series is with Maud de Vautibault, GI Hub’s Director of Practical Tools and Knowledge.

Read time: 5 minutes

Published

08 Mar 2022

View article

Articles

Alexandra Bolton, Executive Director of the Centre for Digital Built Britain shares why we need to invest in digital capabilities to improve infrastructure delivery.

Read time: 5 minutes

Published

11 Feb 2022

View article

Articles

Given its share of greenhouse gas emissions, infrastructure needs to be decarbonised as part of the long-term transition to net zero and the limitation of global warming to 1.5%.

Read time: 9 minutes

Published

08 Dec 2021

View article

Articles

The infrastructure sector needs to make a fundamental shift from built solutions that address singular problems to those that address multiple transformative outcomes.

Read time: 4 minutes

Published

19 Nov 2021

View article

Articles

Cities are at the forefront of the pandemic crisis and are key players in the fight to achieve net-zero emissions targets. The recovery choices they make today will set urban agendas for years to come.

Read time: 5 minutes

Published

20 Oct 2021

View article

Articles

With a USD3.7 trillion global infrastructure investment need that continues to widen, and government debt levels substantially higher than they were after the global financial crisis, recent infrastructure bond issuances offer valuable lessons.

Read time: 6 minutes

Published

15 Sep 2021

View article

Articles

Low-income countries must maintain the necessary focus on basic goals such as improving energy access, providing safe and quality transport services, water, food security, and education - while forgoing opportunity, dealing with additional risks, and prioritising climate-smart investments.

Read time: 4 minutes

Published

24 Feb 2022

View article

Articles

Pension investment in infrastructure is moving mainstream, at a time when this move will have even greater potential to help drive positive impacts

Read time: 7 minutes

Published

04 Feb 2022

View article

Articles

To close the infrastructure gap in a sustainable recovery, we need more greenfield infrastructure, with environmental sustainability at its core. This requires innovative funding models and public-private partnerships (PPPs), particularly in emerging economies where private investors are more reluctant to invest and greenfield infrastructure need is greatest.

Read time: 6 minutes

Published

03 Dec 2021

View article

Articles

The pandemic increased inequalities among vulnerable people and highlighted gaps in access to financing and services in every country. Simultaneously, the climate crisis is still at ‘code red’. From every vantage point, it is clear that we need to get the most possible out of the unprecedented level of infrastructure as a stimulus.

Read time: 4 minutes

Published

10 Nov 2021

View article

Articles

Infrastructure is one of the least technologically transformed sectors of the economy and there is a global consensus that our industry needs innovation to solve big challenges like the resilience of infrastructure during future pandemics, the rise of climate change, urbanisation, and an ageing population

Read time: 5 minutes

Published

15 Oct 2021

View article

Articles

The US Senate has passed the $1 trillion Infrastructure Investment and Jobs Act, the ‘historic’ bill promises vital investment in areas from roads, bridges and trains to broadband access and clean drinking water.

Read time: 7 minutes

Published

18 Aug 2021

View article

Articles

The global pandemic and climate change concerns raised at COP26 have elevated awareness of the need to build sustainable and resilient infrastructure, in tandem with implementing adaptation strategies and governance through innovative and collaborative partnerships between the public and private sectors

Read time: 4 minutes

Published

18 Feb 2022

View article

Articles

Improving the delivery of capital works and maintenance of water networks is essential to improving access to water and to do this, we need to rethink how we deliver infrastructure. Sydney Water has done just this with their Partnering for Success framework.

Read time: 8 minutes

Published

27 Jan 2022

View article

Articles

Sadek Wahba explores four infrastructure related themes that were re-affirmed at COP26 to deliver on a net zero future

Read time: 5 minutes

Published

25 Nov 2021

View article

Articles

Can investment in infrastructure fuel economic recovery? Is there a role for infrastructure in the transition to a circular economy? Hear what insights GI Hub's CEO, Marie Lam-Frendo shared in this interview for the official G20 Italy: The 2021 Rome Summit publication.

Read time: 6 minutes

Published

29 Oct 2021

View article

Articles

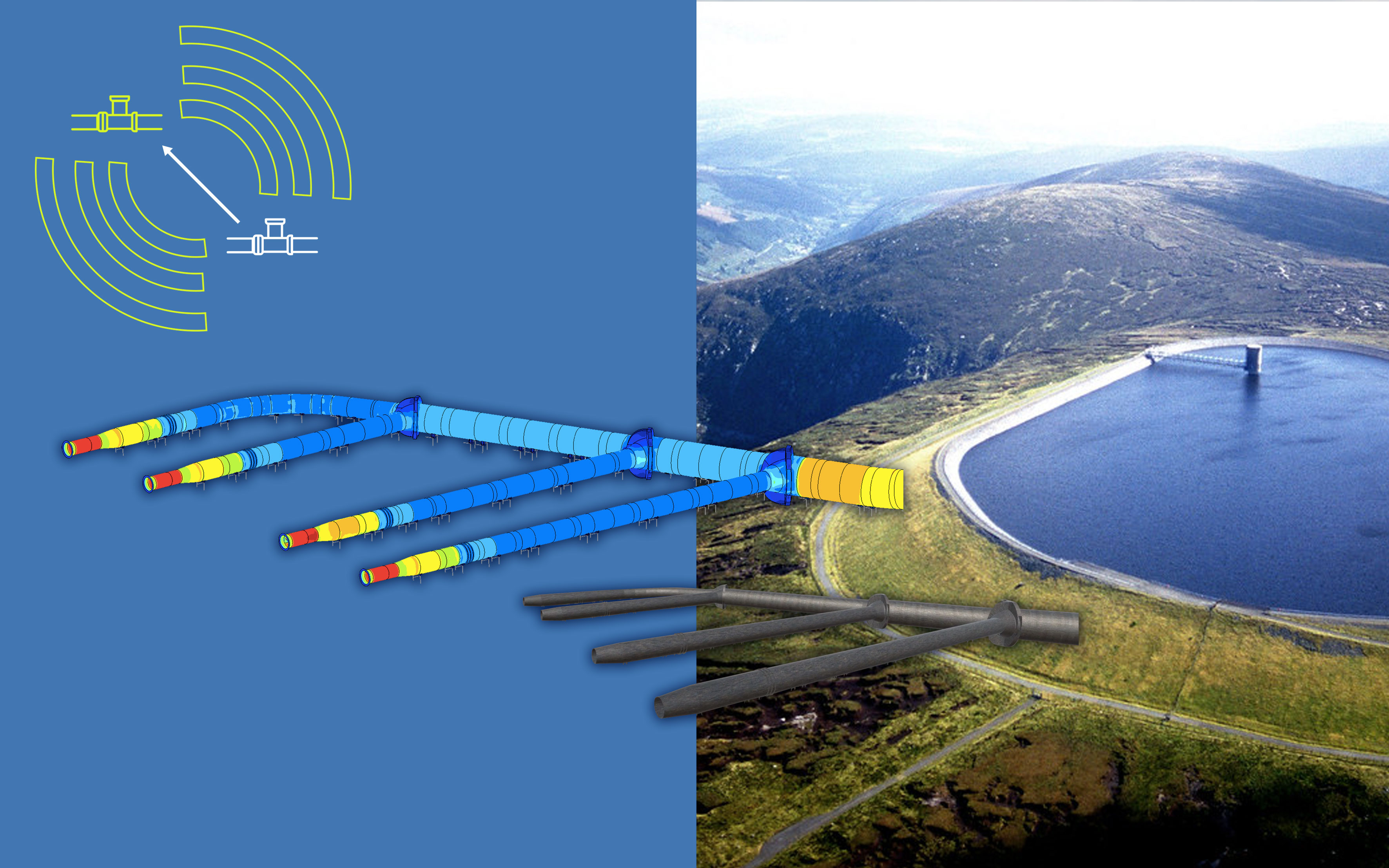

In 2019, Irish electricity company ESB was seeking a solution to help them understand the structural health of its 47-year-old Turlough Hill pumped storage station, which generates up to 292MW into the Irish grid during peak demand periods and – as Ireland’s only pumped storage station – has a crucial role in the country’s ongoing transition to renewable energy grid stabilisation.

Read time: 6 minutes

Published

23 Sep 2021

View article

Articles

What role should an Infrastructure Commission play in Northern Ireland? Could it help build a pathway to net zero? And what signal would it give to the private sector? GI Hub speaks to Kirsty McManus and Richard Johnson of Northern Ireland's Ministerial Advisory Panel on Infrastructure for answers on these questions and more.

Read time: 8 minutes

Published

06 Aug 2021

View article