1738 results found

Featured results

More results

The Asian Infrastructure Investment Bank (AIIB) platform takes a holistic approach to financing support for the development and deployment of technology for infrastructure projects. This support is in the form of knowledge, networks, capital, innovation services and regulatory dialogue with members, investment leads, and clients.

This report on Infrastructure Transition Pathways, prepared for the G20, examines what governments are doing to incorporate infrastructure transition pathways into their infrastructure plans.

SIFP equips senior leaders in emerging markets with the skills to increase private investment in sustainable infrastructure.

The GI Hub’s CEO Marie Lam-Frendo and Director of Engagement, Rory are on the ground at COP27, read about their week ahead.

During COP27, our guest authors from WAPPP, CPCS Transcom Ltd and Princeton University explore recommendations for integrating and mainstreaming three climate-related risks.

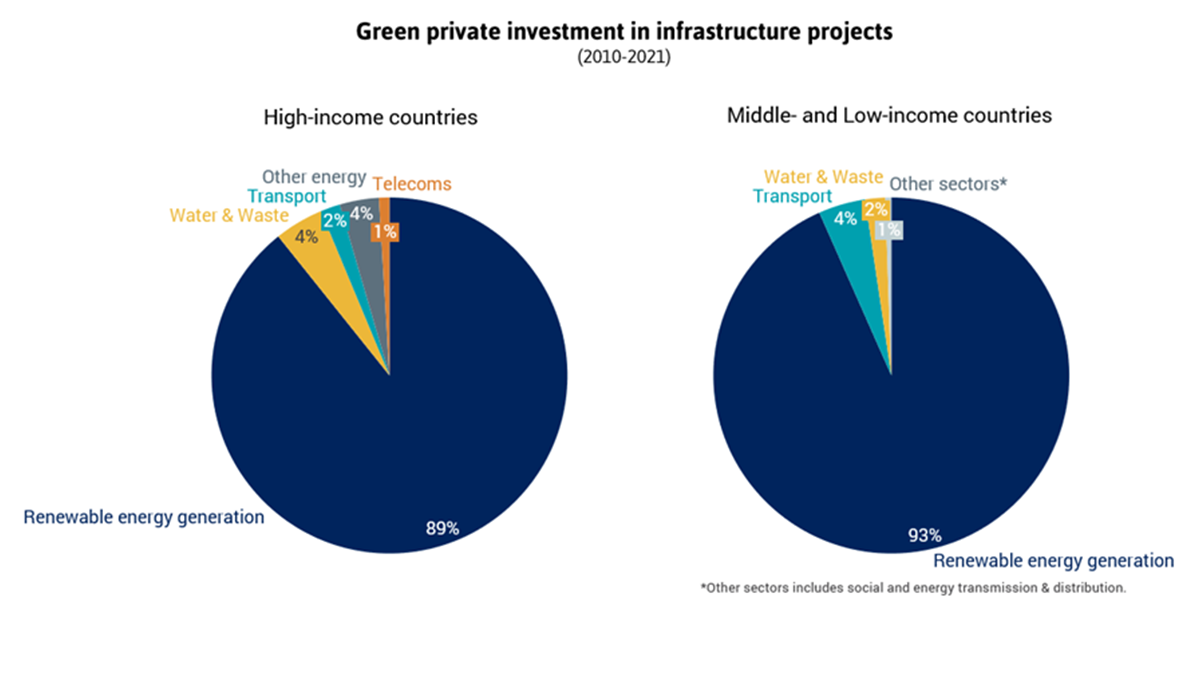

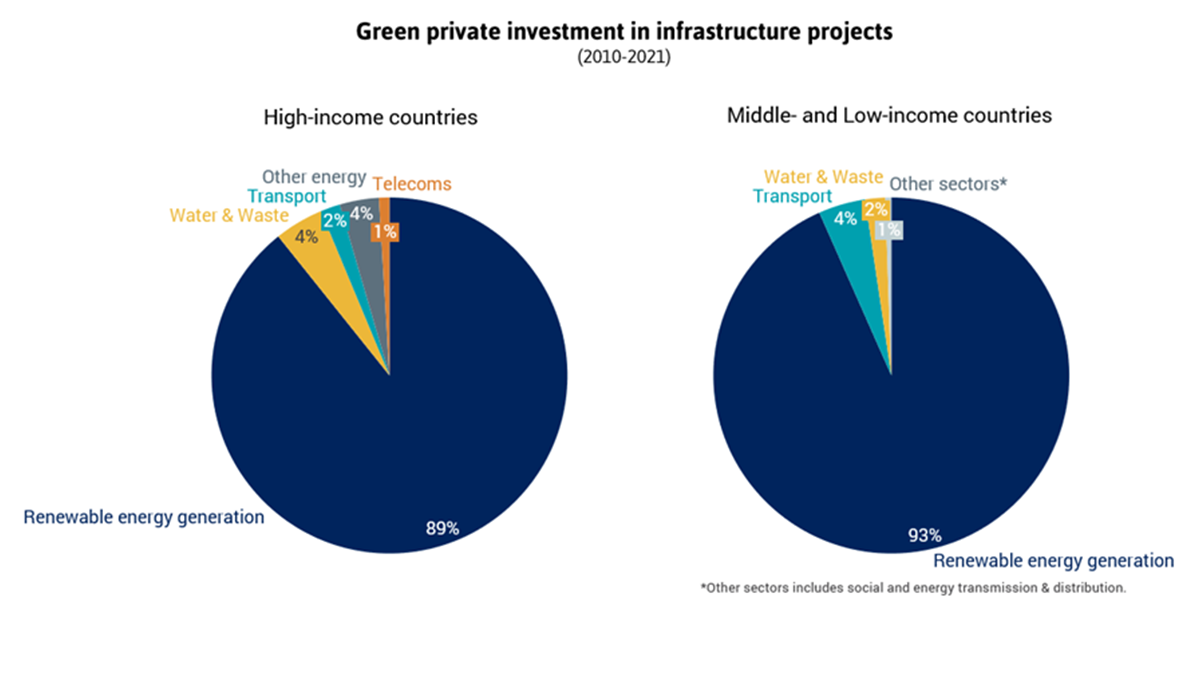

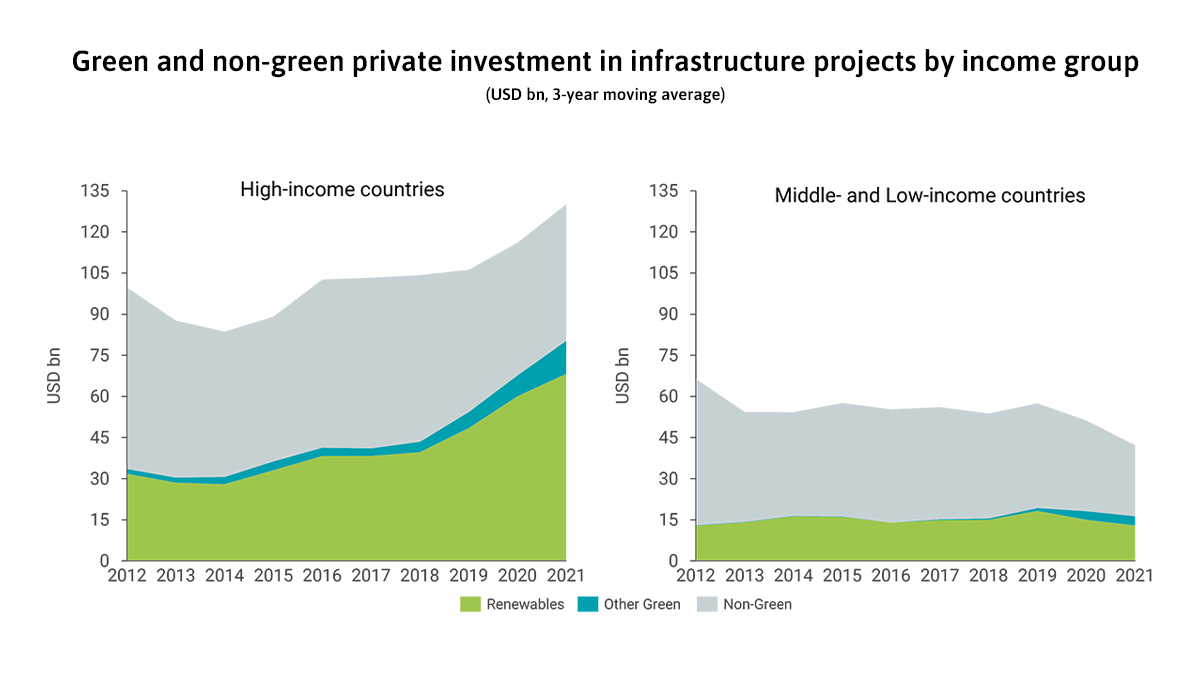

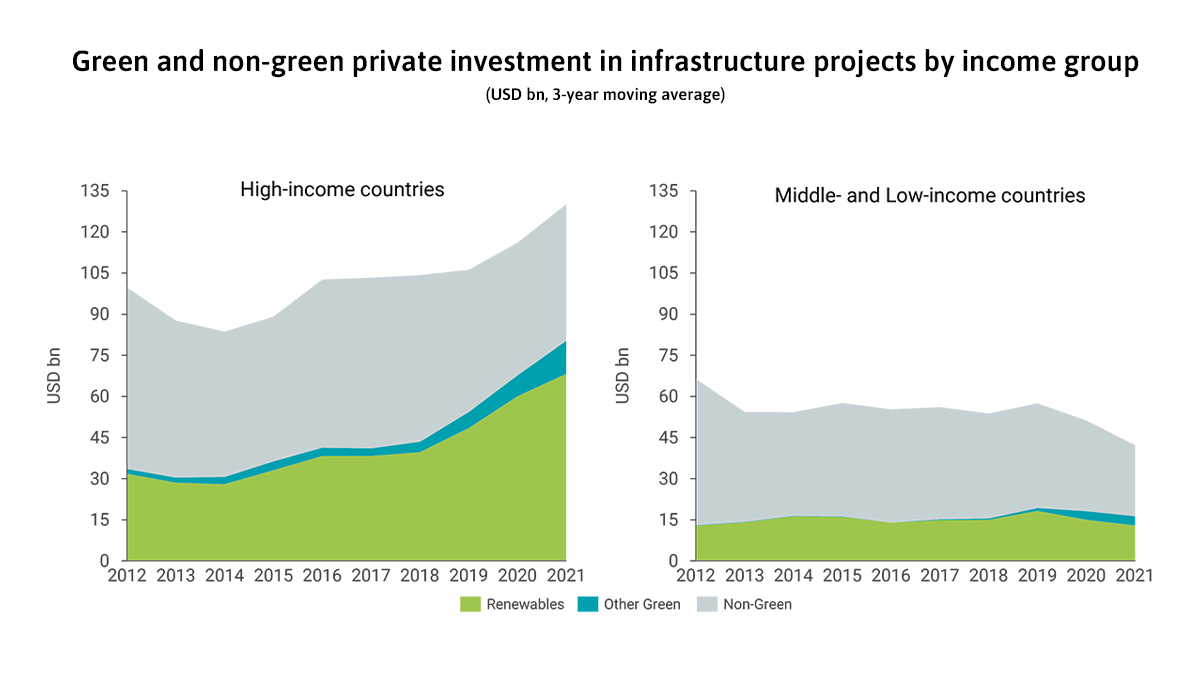

Green investment in infrastructure outside of renewables is limited. While renewables represent almost 90% of total green private investments in infrastructure projects, green investment in other sectors only represent 14%.

At COP27 this week, GI Hub CEO, Marie Lam-Frendo moderated a panel session on Accelerating, Targeting, and Blending Sustainable Investment at the Sustainable Markets Initiative Terra Carta Action Forum.

This is a testament to multilateralism, even in challenging times

The Global Infrastructure Hub welcomes yesterday’s launch of the G20’s Pandemic Fund to address pandemic prevention, preparedness, and response, particularly in vulnerable countries.

The G20’s Pandemic Fund will help ensure sufficient, long-term, and better coordinated financing for pandemic prevention, preparedness, and response, and strengthen the capacity of low- and middle-income countries’ health systems.

GI Hub’s Sam Barr, explores why the time has come for a long-term approach to investment in health infrastructure.

This week, the G20 Heads of State and Government Summit was held in Bali, Indonesia. The Summit had the world’s attention, as we looked to G20 Leaders to tackle the multiple challenges of the war in Ukraine, increasing inflation and the global economic slowdown, and climate change.

In 2021, global green private investment in infrastructure projects in primary markets rose to a record-high share of 60%, but this trend needs to accelerate and expand beyond renewables to meet climate goals.

The current energy crisis underscores the urgency to scale up green infrastructure investment.

After seven weeks of intensive training on infrastructure project finance and delivery, the third cohort of the Africa Infrastructure Fellowship Program graduated last month.

We need more investment in economically, environmentally, and socially sustainable infrastructure, but there is real danger that investment by both the public and private sectors may slip backward

The Global Infrastructure Investor Association (GIIA) in partnership with PwC, published Unlocking Capital for Net Zero Infrastructure. Based on interviews with infrastructure investors, the report identifies an urgent and immediate need for additional investment in order for the UK to meet its ambitious net zero targets.

Transition Pathways

Transition Pathways