1103 results found

Featured results

More results

Join the GI Hub and G20 Italian Presidency for day two of the InfraChallenge final, in which the Top 10 competitors will give their final pitches of their solutions, and the 2021 winner will be announced.

A solar leasing project at Singapore's Jurong Port significantly reduced carbon emissions and generated cost savings.

Tel Aviv is Israel’s second-most populous city and its main business, technological, and cultural center. Its population has grown at 2% per year; Israeli population growth is ten times the OECD average.

In Senegal, energy is produced by private operators and sold to the Senelec government energy corporation.

Since 2010, Senegal had pursued reform policies within the energy sector, and aimed to increase installed renewable energy to 20% of total installed capacity by 2017.

A significant risk for foreign investors in developing and frontier markets is exchange rate risk, which can greatly alter a project’s rate of return.

This new technology is particularly relevant for boilers, air conditioning, solar power, and lighting infrastructure.

Small- and medium-sized enterprises (SMEs) may benefit greatly from the energy cost savings that result from the installation of new, more efficient technology.

Uganda is targeting a 22% emissions reduction from a business-as-usual scenario by 2030.

Uganda is targeting a 22% emissions reduction from a business-as-usual scenario by 2030. A run-of-river hydropower station project lowered energy costs and reduced greenhouse gas emissions.

The Mohammed bin Rashid Solar Park is the largest single-site solar park in the world; it uses an Independent Power Producer (IPP model) and a build-own-operate project structure

The UAE Vision 2021 includes the Green Economy for Sustainable Development Initiative. This includes sourcing 75% of Dubai’s power from clean sources by 2050, and 25% from solar power

The mechanism allows borrowers to obtain financing under syndicated loan (credit) agreements to deliver state-backed infrastructure projects

The Factory is a project finance mechanism for investment projects in Russia’s priority industries, which include manufacturing, heavy engineering, nuclear industries, infrastructure, agriculture, healthcare, and information and communication technology

Long-term local currency financing is scarce in Kazakhstan. It is only available under state support programs targeting large investment projects for strategic sectors and affordable housing

Hard currency borrowing in Kazakhstan was popular until the Tenge currency collapse in 2014-2015. Borrowers then started looking for local currency financing, but the local market for long-term financing was under-developed

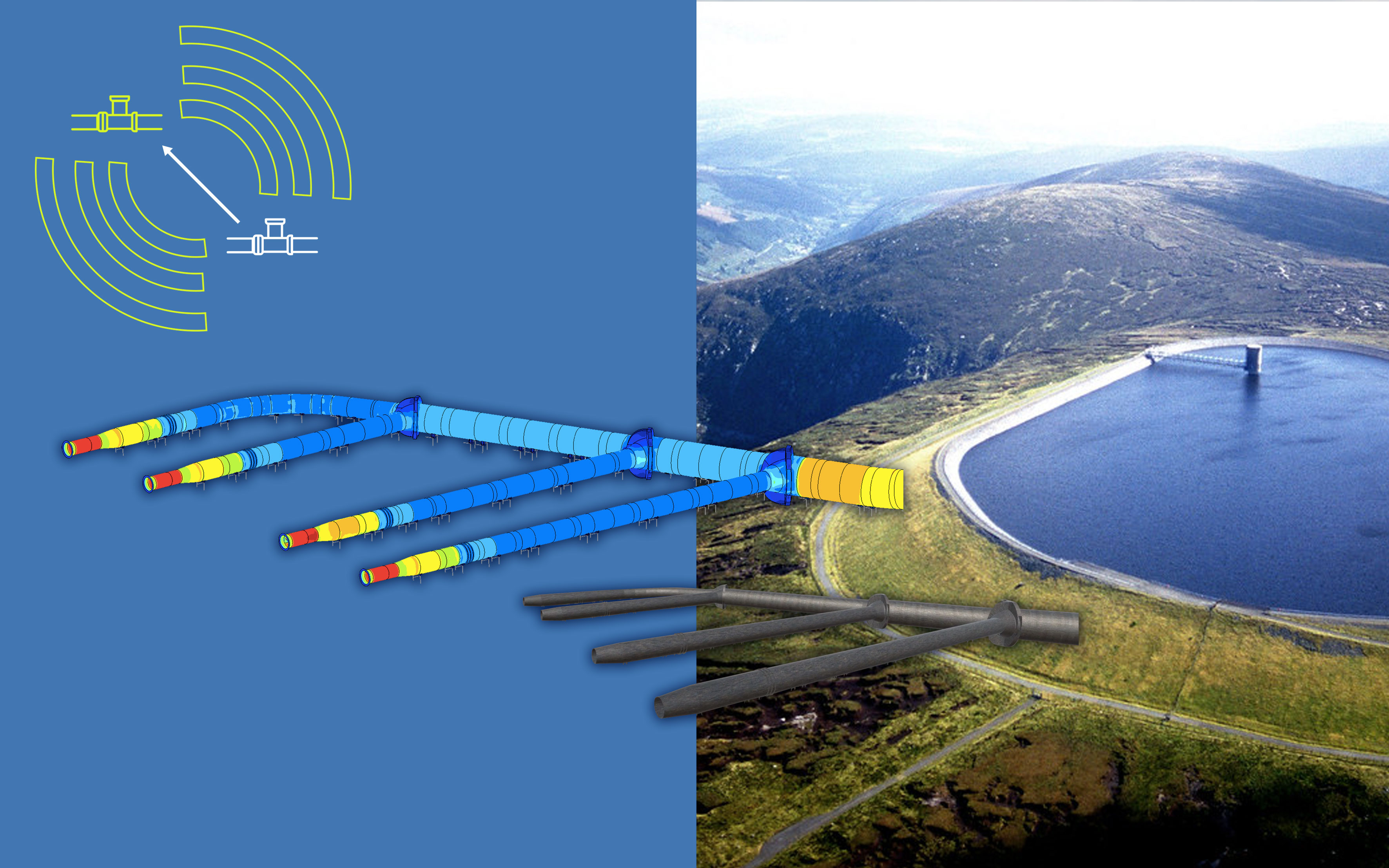

In 2019, Irish electricity company ESB was seeking a solution to help them understand the structural health of its 47-year-old Turlough Hill pumped storage station, which generates up to 292MW into the Irish grid during peak demand periods and – as Ireland’s only pumped storage station – has a crucial role in the country’s ongoing transition to renewable energy grid stabilisation.

The recording is now available for the GI Hub and Italian G20 Presidency’s InfraChallenge 2021 Final which was held over two-days on 15 and 16 September 2021

What role can the private sector play in a green transition? How is green financing implemented, and what are the current green financing trends? These are a few of the key questions that will be explored in this GI Hub and IFC webinar.

A green bond issuance by Continuum Wind Energy contributed to the continued growth of India's renewable energy sector.

The Joint Report on Multilateral Development Banks Climate Finance is an annual report that makes public the MDB climate finance figures, with explanation of the methodologies for tracking this finance.

The New Climate Economy explores how countries at all levels of income can have better economic growth and a better climate.

G20 Leaders endorsed the High Level Principles on Long-Term Investment Financing by Institutional Investors in September 2013, which is intended to help governments facilitate and promote long-term investment by institutional investors.

The G20/OECD Checklist consists of a list of questions and issues that represent an effort to develop an evaluation tool to help those countries who wish to self-assess their long-term investment (LTI) strategy and policy framework and more.

This Checklist for PPPs has been prepared from the point of view of public policy makers and decision-makers in countries at various levels of development and capacities for the purpose of a high level assessment of a PPP project.

InfraChallenge website

InfraChallenge website