Daystar Power Nigeria

Context

- Nigeria’s electricity sector is plagued with chronic reliability issues, with at least 32 power outages per month, ranging from four to 15 hours. Only a quarter of grid-connected generation capacity (3.6GW out of 13GW) is operational.

- To meet demand, Nigerian commercial and industrial customers rely on self-generation, diesel units and smaller gasoline-powered generators to meet a significant portion of total demand. The cost to operate these generators amounts to USD14 billion annually for the country and has detrimental impacts to individual health and the environment.

Stakeholders involved

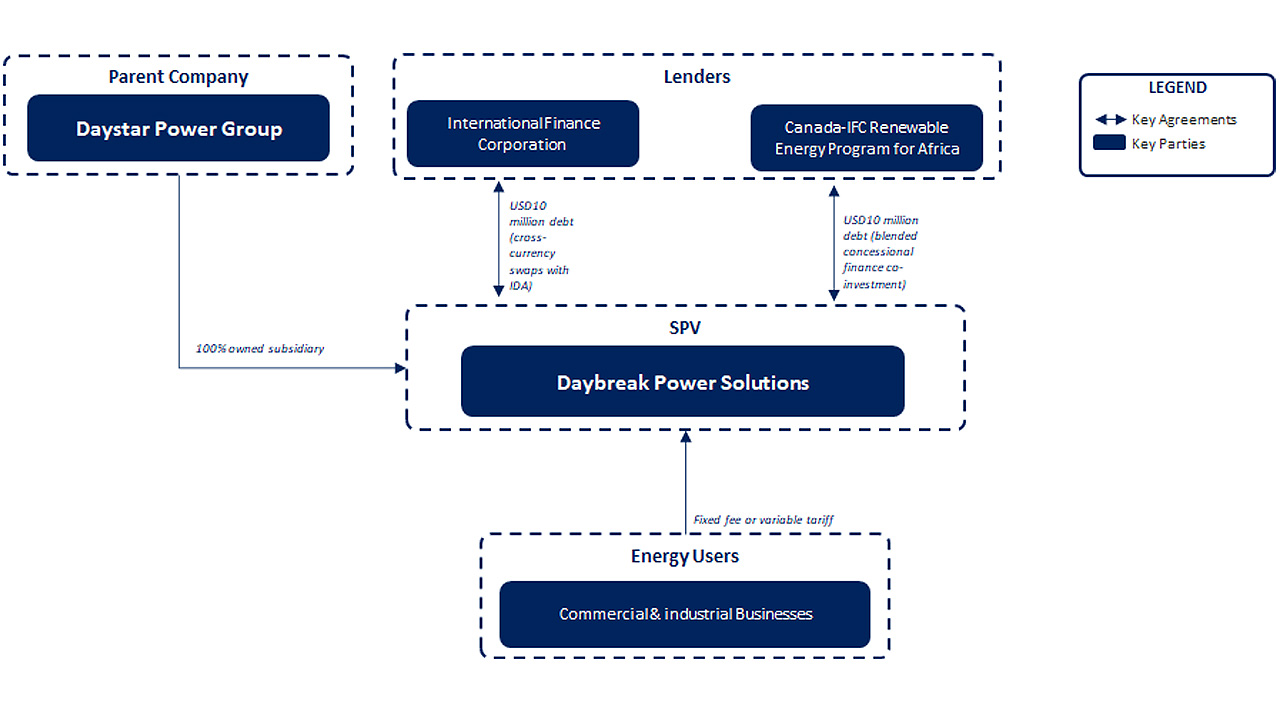

- Daybreak Power Solutions is a 100% owned subsidiary of Daystar Power Group

- Daystar Power Group has operations in Nigeria, Ghana, Togo, and Senegal. It also has a representative office in Côte d’Ivoire

- DEG, the German development finance institution, was one of Daystar Power Group’s first investors, through its ‘Up-Scaling’ grant funding program

Problem

- The Federal Government of Nigeria (FGN), as part of its Power Sector Recovery Program 2017 to 2021, estimates that the country loses USD29 billion annually arising from insufficient and unreliable electricity supply.

- This results in a lack of access to electricity, a contributing factor to the lack of investment into the Nigerian economy.

- Businesses lack the expertise, risk capital and financing to invest and adopt solar energy to alleviate issues of unreliability and insufficient supply.

Innovation

- Daystar installs and operates hybrid solar solutions for commercial and industrial businesses who are either heavily reliant on diesel generators or receive intermittent supply from the main grid. The result is a clean, reliable and competitive energy supply. In certain cases, it takes over the entire power management for its customers.

- Daybreaks business model is to achieve an energy cost saving for its commercial and industrial customers primarily via the displacement of diesel generation with solar and battery-based solutions. The clients pay either a flat monthly fee or a variable tariff adjusted for certain pass-through items. No capital expenditure is paid by the clients.

- The project leverages IFC’s expertise, risk capital and mobilisation of future debt (for future phases of the company’s expansion) to support the development and expansion of the country’s underutilised solar resources:

Financial: IFC committed of a seven-year USD20 million junior debt package, comprising of a local currency (Naira) subordinated loan of up to USD10 million equivalent hedged through cross-currency swaps with IDA PSW LCF, and up to USD10 million concessional subordinated loan from the Canada-IFC Renewable Energy Program for Africa.

Technical: sharing IFC’s technical knowhow in the solar and distributed generation space to enhance operational efficiency.

Corporate governance: providing advice to support the improvement of the company’s corporate governance.

Social inclusion: supporting the company with its plans to integrate gender diversity in their workforce through improvements in workplace policies and practices with the goal of increasing women’s participation in leadership and in technical roles. IFC’s supports the company in the continued application of international best practice standards on environmental and social impact mitigation measures.

Timeline

Results and impact

- Financial benefits: through the provision of a subordinated loan, IFC will help to meet the company's current funding needs, de-risk future senior debt and facilitate access to competitive longer-term senior debt.

- Adoption of international best practice: IFC’s involvement has helped support the integration of international best practice into future projects with investments required to be managed in accordance with the performance standards that cover environmental impacts, working conditions and community health and safety.

- Significant emission reduction: emission savings from the project are estimated at 32,700 tons of CO2 per annum.

- Provision of stable and reliable power: the project is expected to increase reliability and affordability of electricity for commercial and industrial customers facing unstable supply. The Company has grown and has c.20MW of solar PV installed across 250 sites with 35 customers, which is the second largest commercial and industrial solar company in Nigeria.

- Economic impacts: The project supports growth and employment generation in the Nigerian economy, by expanding alternative reliable power solutions provided cost effectively to commercial and industrial customers.

Key lessons learnt

- Concessional funding is required to help nascent business models of distributed generation assets to become financially viable.

- Access to local currency financing is critical to the success of distributed generation businesses.

- Lenders need to develop innovative structures to fund distributed generation businesses; using a project finance template will be too constricting and not appropriate.

- Local, on the ground presence is crucial in growing distributed generation business.